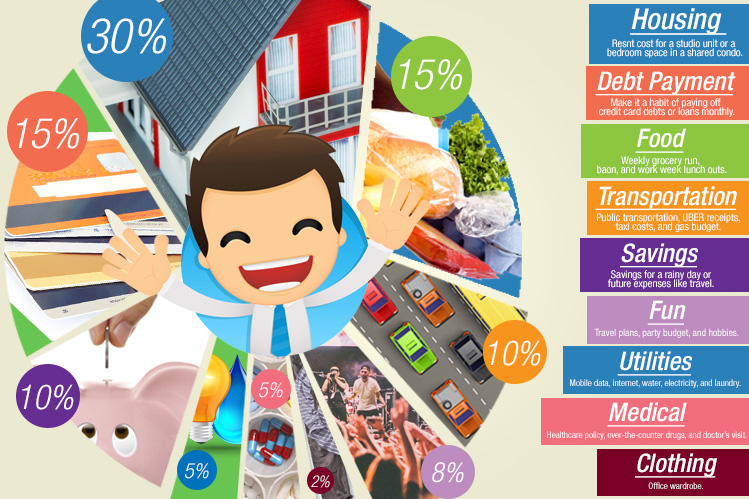

Infographic: How Much Should You Spend on Living Expenses

Share

Just because you live on a budget doesn’t mean you can’t live in style. Nowadays, many millennials live independently either in shared condos or their own.

When you fly out of the family nest and try to live alone, you’ll realize that this so-called “adulting” is tough, yet comes with a lot of perks and battle scars that you can only gain when you venture out on your own.

Individual circumstances may differ, especially when you factor in familial obligations, location, career level, and lifestyle. But, it’s not really about having a bigger, dispensable income. The magic is in the budgeting.

So, here’s a basic guide on how much you should spend on living expenses.

Housing (30%)

Renting is always the better option for young professionals. Apart from the cheaper cost of renting compared to buying, a rented apartment or condo space won’t tie you down for the next 30 years. When choosing a rented space, factor in the distance you need to travel from your home to the office, as the proximity to major transportation hubs also affects your monthly transportation budget.

Food (15%)

Your monthly food budget includes your daily work java, weekly grocery haul for your work baon, and Netflix food binges. It also covers your workday lunch outs. This eats up a big chunk of your monthly income, but if you can lower this down to just 10 percent, then you have more to save and/or splurge. You can start by bringing baon and coffee to work.

Debt Payment (15%)

Make it a habit to pay off your credit card debts and loans monthly, so they don’t add up and swallow you alive. Be careful when using plastic, as interest rates can add up and strike a deathly blow to your financial health. As much as possible, use cash.

Savings (10%)

Just because you’re livin’ la vida loca doesn’t mean you can burn all the money you earn. Saving a small portion of your monthly pay for a rainy day or future expenses like traveling or buying a home is a must.

Transportation (10%)

This covers your public transportation fares, UBER and GrabTaxi receipts, gas budget, and parking costs if you have your own car. Your transportation budget depends heavily on your housing location. If you can find a place that is a short distance to your workplace, consider walking instead of hailing a cab.

Fun (8%)

Your place, your rules. So let’s be honest here, you’re most likely going to spend a huge sum of money for fun. Sticking to a weekly and monthly budget will keep you from going overboard. You work hard for the money, go spend it…wisely.

Utilities (5%)

Water and electricity bills are often manageable as long as you pay them regularly. Affordable laundry services are everywhere, but if you have a washing machine, you can save on this too. If you’re mostly out of the house, think twice before getting your own Wi-Fi service. Also, make sure to pay your postpaid plan regularly to avoid unnecessary stress and costs.

Medical (5%)

If you have healthcare or insurance policies, pay them regularly. Setting aside a cumulative petty cash for OTC drugs and doctor’s appointments is an easy way to unconsciously save money for health-related emergencies.

Clothing (2%)

You don’t need to buy new office clothes every month. But just like your monthly budget for medical expenses, you can create a “roll-over” budget for office wardrobe. If you’re earning PHP 50,000 a month, that’s PHP 1,000 a month. In six months, you can go crazy at H&M with PHP 6,000 cash to burn. It’s a long wait, but the goal is to shop rich not just look rich and starve or drown in debt for the next few months.

If you need to use the plastic because, hey, it’s zero percent interest rate and 12 months to pay, just factor in the project cost.

Budget Smarts

Looking at your projected monthly costs and tracking your expenses can save your from spending more than what you earn.

Budgeting has gone digital. There are many mobile apps that you can use to track expenses such as Goodbudget and Monefy, which you can also use to remind you of bill payments and other scheduled expenses. And if you’re in need of fast, instant cash, pawnshops have also gone digital.

Managing your financial health is easier than you think in today’s highly digital world.