11 Money Apps That Will Help You Save BIG

Share

Budgeting one’s finances is a necessary evil. As long as you keep consuming your needs and wants, there’s no escaping money management.

Managing finances is quite a challenge for Filipinos today. In fact, 55% of Filipinos are having insufficient money to pay for food or basic necessities according to a survey by the World Bank in collaboration with the Bangko Sentral ng Pilipinas. If that’s the case, how can you save?

Saving money doesn’t have to be an ordeal. Here are money mobile apps you must download to help you save BIG!

General Expenses

This popular app lets you consolidate your accounts—from bank accounts and mutual funds. Each section is intuitively organized to give you the big picture of your finances, along with all the tools you need to manage your earnings, spending, saving, and budgeting.

Further, it shows your cash flow in real-time including deposits, expenses, credit card debts, and other investments. This format is great if you’re especially into using your debit or credit cards for all purchases, but it also works with cash as long as you enter every purchase.

Lastly, the app analyzes your spending habits, helping you identify areas where you can potentially save. If you’re forgetful about balances, you can set a low-budget alert and Mint will email or text when you hit it.

YNAB is a detailed yet user-friendly app with a software that operates by four rules:

1) Give every dollar a job

2) Save for a rainy day

3) Roll with the punches

4) Live on last month’s income.

YNAB’s goal is to change the way you manage money and to create stress-free finances.

- GoodBudget (formerly EEBA)

This app is great for people who are ready to start creating a budget based on their cash flow—perfect for freelancers, too!

Its envelopes system is similar to putting allocated amounts of cash into actual envelopes per month. Also, divvy up your monthly budget and understand spending habits in each area of your life with the app.

For items that land in your recurring budget, select the time frame as monthly, weekly, semi-monthly, or every two weeks, and then pick a start date.

Every week, Guide Financial scans your transactions and sends a report on your expenditures. You will also receive personalized financial advice and coupons and deals based on your spending patterns.

Pocket Expense tracks your spending and gives a visual outlook on your spending before creating budgets, as opposed to the other way around.

The app does not sync with your bank accounts. You manually enter all transactions, making the app ideal if you’re concerned about linking accounts.

To get a breakdown of how much you spend versus how much you have combined, go to the Calendar tab and take a look at expenses per day, week, or month—all color coded. Then, set up a budget under the Budgets tab and check out Charts for your spending breakdown.

the app has amazing tools relevant in keeping track of your overall expenses. “SmartScan” lets you photograph, categorize, and tag receipts, and then add them to expense reports if necessary. You can also enter the merchant name, the total amount spent, and date for each expense.

If you prefer manual input, “Add Expense” offers the categorizing options. You can also note if the expense is billable and/or reimbursable by the flip of a few switches.

The “Track Distance” option is especially handy for freelancers who travel by car and want or need to bill by distance. Here, you can track by odometer, or just turn on location and use the app’s GPS.

The “Track Time” option offers a way to keep tabs on hourly earnings, which are based on a set hourly rate.

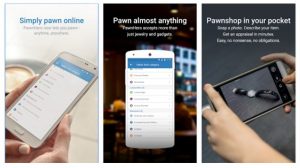

Are you running low on finances? Do you need fast cash for short-term necessities? PawnHero, the first online pawnshop in the Philippines, can answer your urgent cash needs.

PawnHero is not your usual brick and mortar pawnshop, as it allows you to pawn all your pre-loved items—from jewelry, gadgets, home appliances, and even automobiles online right in the comfort of your home! Aside from these unique offerings, they also have a low monthly interest rate at just 2.99%.

And now, you can even conduct your transactions through the PawnHero mobile app.

(Image Source)

Shopping and Groceries

Ibotta enables shoppers to earn real money while doing their hobby. Start by perusing the different offers in the product gallery and choose the ones you’re interested in.

Every time you complete a “task” (like sharing on Facebook, taking a poll, or watching a video), pending cash is added to your account that can be accessed once you actually purchase the product from one of the 50 retailers partnered with Ibotta.

Stick with your budget, accomplish a task, and avoid impulse purchases with this incredibly detailed grocery shopping list platform.

Not only can you build grocery lists by searching through the millions of products in the app’s database, but you can use voice recognition or barcode scanning as well.

Travel

Trivago compares the cost of hotel rooms on booking sites like Hotels.com and Expedia and lets you know which site offers the best deals.

Browse user reviews and photos, and filter search results according to price, amenities, distance, and star categories.

This international app allows you to find incredibly low prices on last-minute hotel bookings. Amazingly, you can arrange same-day reservations until 2 a.m. and for multiple nights, making it a lifesaver for everything—from unexpected layovers to spontaneous vacations.

Hotel Tonight is constantly adding new locations and has stellar 24/7 customer support to keep their customers happy.

Keeping a balanced budget is a tough challenge for anyone, but done right, it will help stay on top of things. However, if your money-management system requires sifting through piles of receipts and retrieving cash from various pockets and purses, it’s time to reconsider your approach!

With these apps, you can have a better understanding of your daily, weekly, and monthly expenses and keep your savings intact.